Rethinking grocery shopping in the internet age

This is a story of "What could have been?": a product I helped build that excited customers, wowed investors, and showed tremendous engagement numbers, but ultimately fell victim to the startup grim reaper. I still see a tremendous hole in the grocery market that some dream grocer could be filling, and I hope this article serves to inspire consumers to demand a better user experience from the food companies that serve them in the internet age. Selfishly, I miss not being able to use this product every week so would love to see its vision fully realized!

Relay Foods was an online grocery store that started in 2011, well ahead of the current online grocery wave. Not only did we offer the convenience of home delivery, we also invested heavily in local food ecosystems, allowing consumers to purchase items from hundreds of local producers alongside products from well known brands.

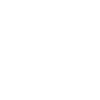

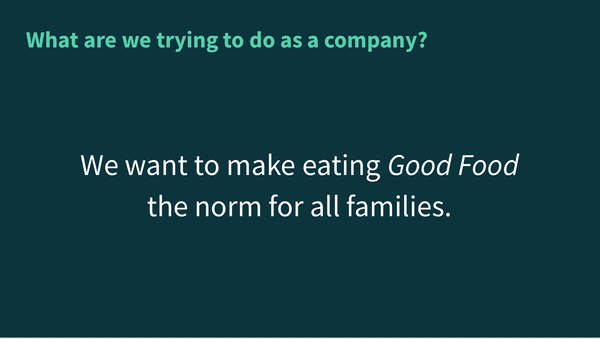

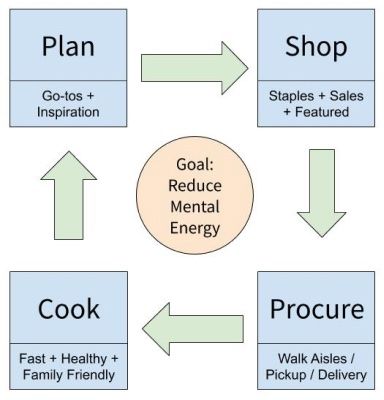

Although we had a small but loyal customer base, by 2015 it was clear that for our customers – mainly Gen-X Moms – what we were doing wasn't enough. Despite the convenience of mobile shopping + home delivery, they'd continually fall back into their physical grocery store routine because it was a known quantity of mental energy each week. We heard countless times that the hardest part about grocery shopping is figuring out the full planning/shopping/cooking equation, not just the delivery part (see my mental energy in grocery blog post for more):

Through a deep product discovery process that included user interviews, prototypes, and various iterations, we learned that one of the core issues with most physical and online grocery stores is the separation of planning from shopping. Each week, the process requires figuring out what meals to make, then doing ingredient math for how many of each item is required, and finally, walking the aisles to pick the items out (which often results in buying more than expected):

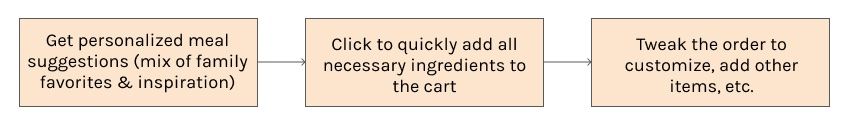

Most of the customers we talked to wanted to shop like this:

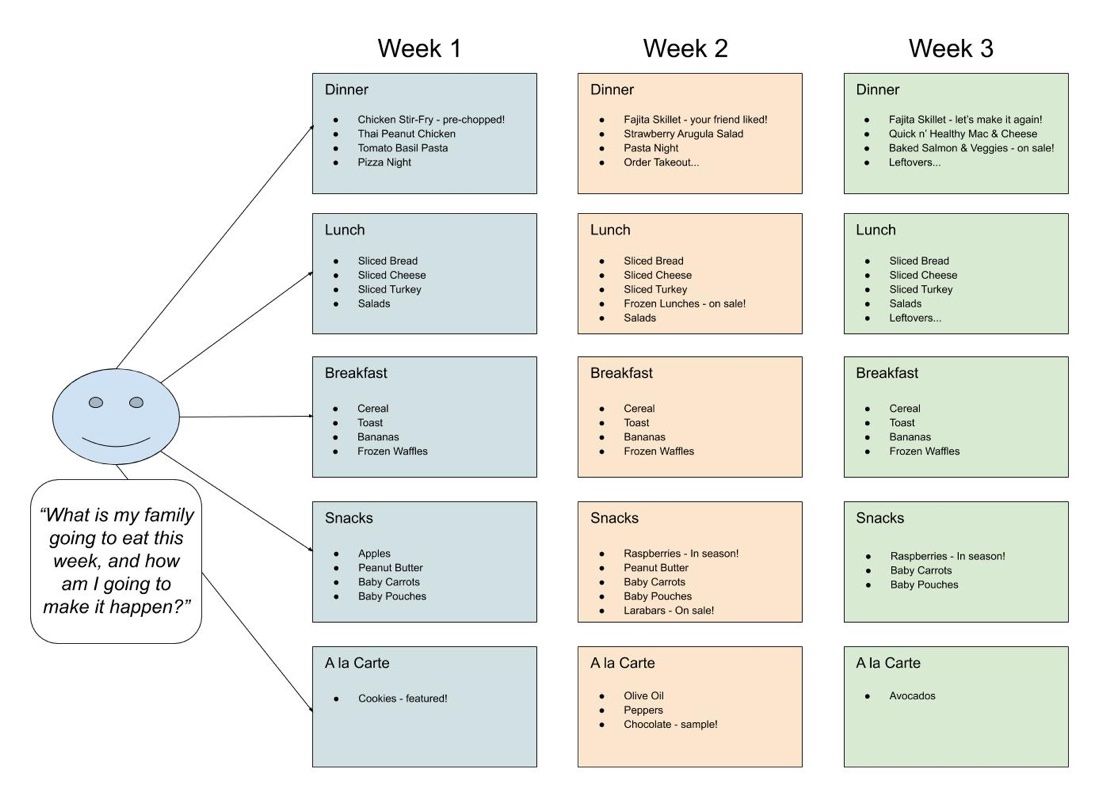

In fact, a large % of customers described their grocery thought process this way:

- What staples, breakfast/lunch faves, snacks, pantry items, etc. are we low on?

- How many nights am I planning to make dinner vs. go out, eat leftovers, etc?

- For those "make dinner" nights, which of our family's 10-20 go-to recipes should I make based on items I have / what's on sale / what's in season?

- Am I feeling ambitious enough to tackle a new recipe this week?

We created this diagram (see here for more fidelity) to visually showcase an example of what this looks like:

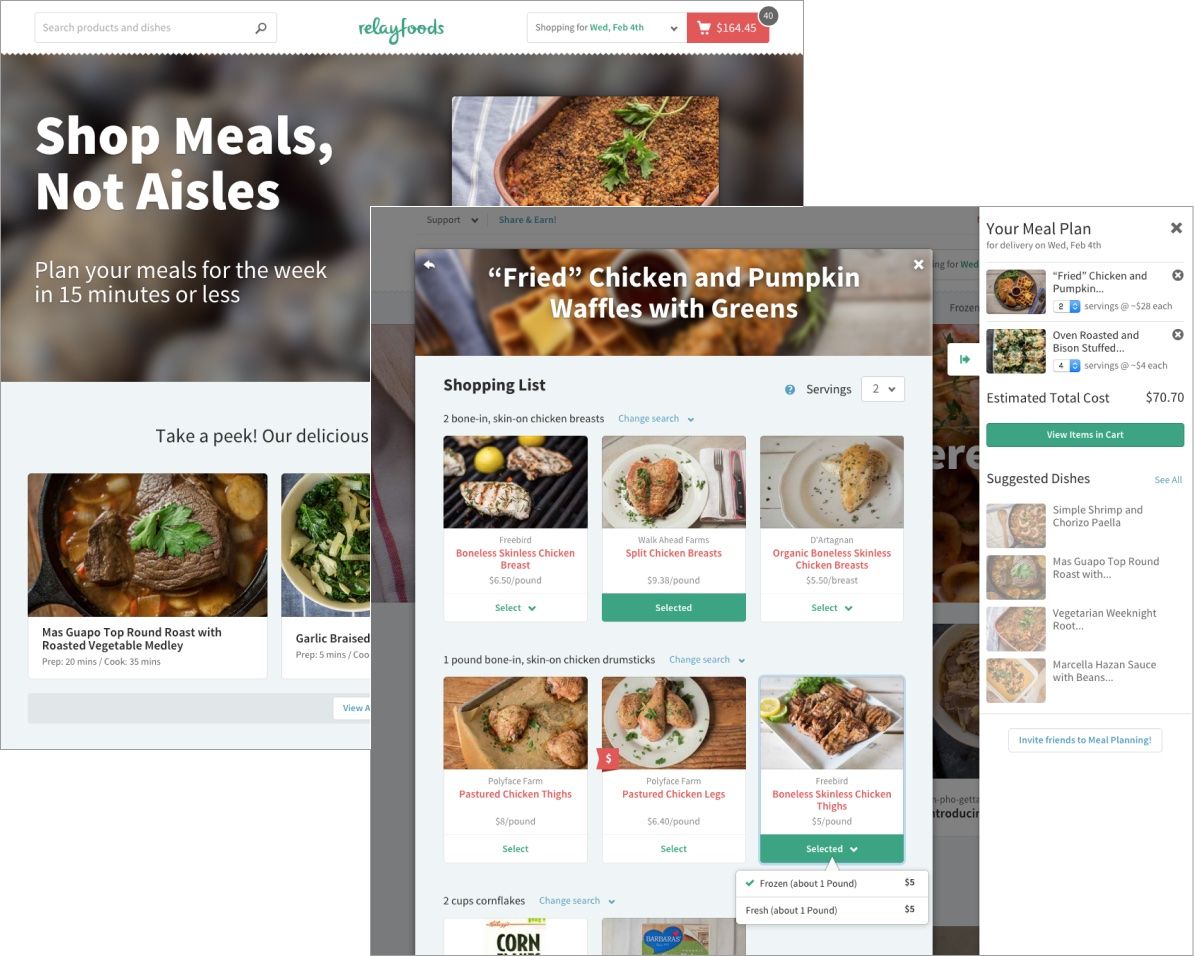

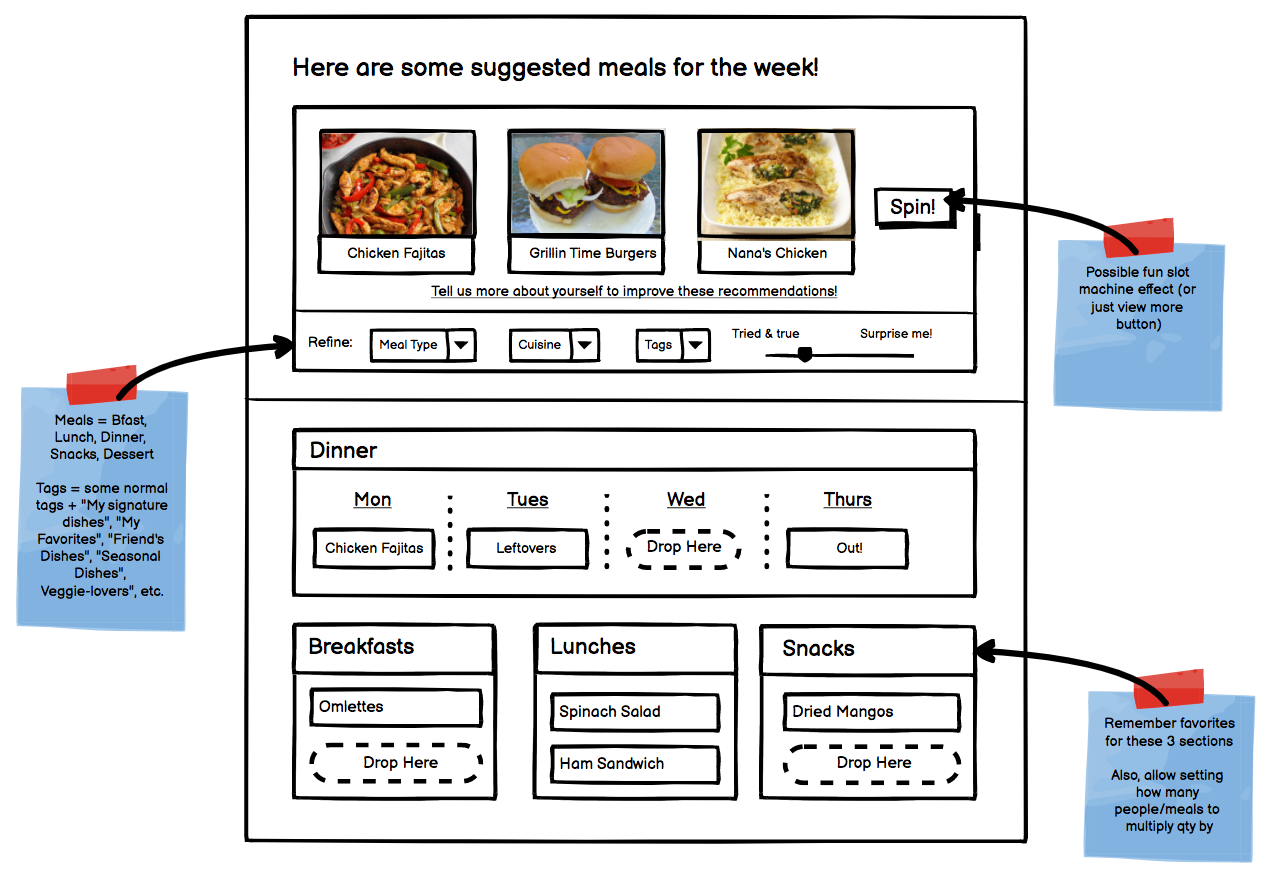

We took these ideas to heart, first with a feature called Refill which I'll share more about in a later post, and then with a feature called Meal Planning, which launched in 2015 and looked something like this:

Lo and behold, investing in the user research phase and creating a cohesive product + marketing + merchandising plan paid off. Customers seemed to love it, and the metrics were really exciting. Within a few months:

- ~30% of the existing customer base was actively using the new (opt-in) Meal Planning shopping paradigm.

- These existing customers began spending 15% more ($89 => $102) on their orders, on average, after they switched.

- New customers spent 49% more ($85 vs. $57) on their first order when using Meal Planning compared to other new customers.

- New customers were 42% more likely to place a second order when using Meal Planning on their first order compared to other new customers.

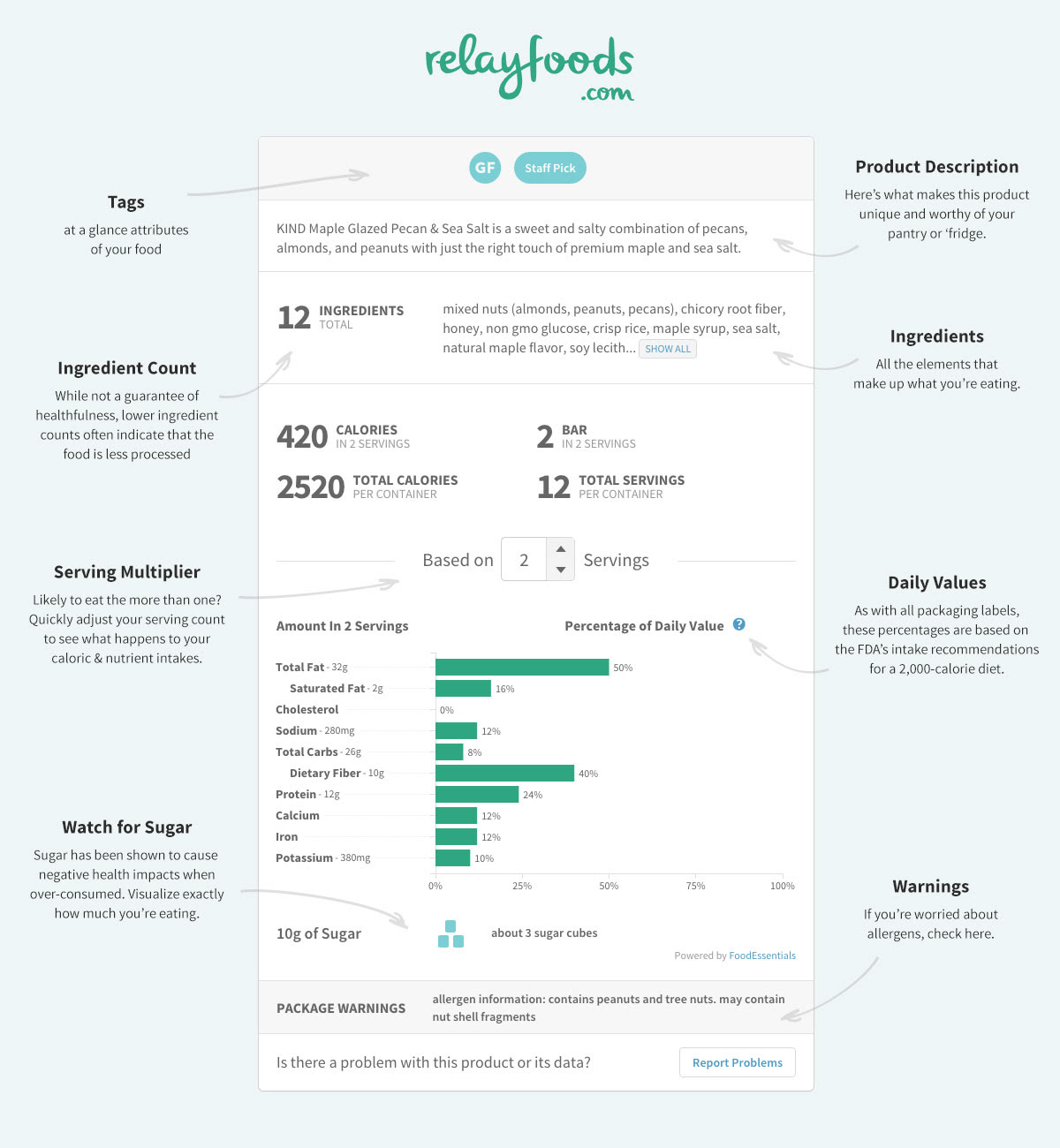

What's not obvious from the screenshots above is the smart technology that enabled this success. There were (and are) other grocery websites that have "shoppable recipes" where you can browse recipes and turn them into shopping lists. In fact, Relay had this feature prior to building Meal Planning, and it was little used. The feature seems useful at face value, but falls substantially short for most users because it isn't smart enough to handle the nuances of grocery shopping. Here are some of the features that Relay employed that differentiated it:

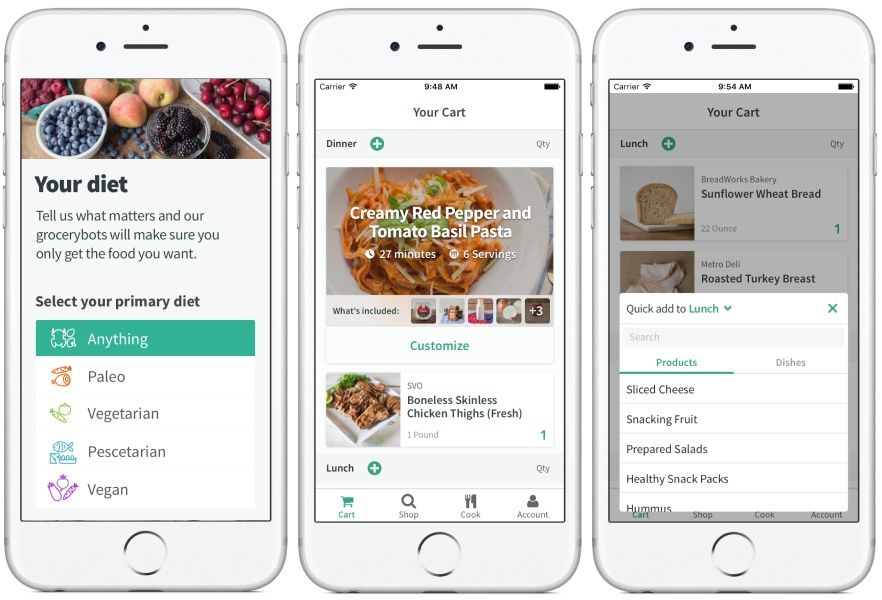

- As you browsed the site, we would suggest recipes based on 1) your shopping history (i.e. which seem to be your family favorites), 2) your dietary profile (e.g. vegetarian with a nut allergy), and 3) this week's sales & features (i.e. which recipes could be made with current on-sale or featured products).

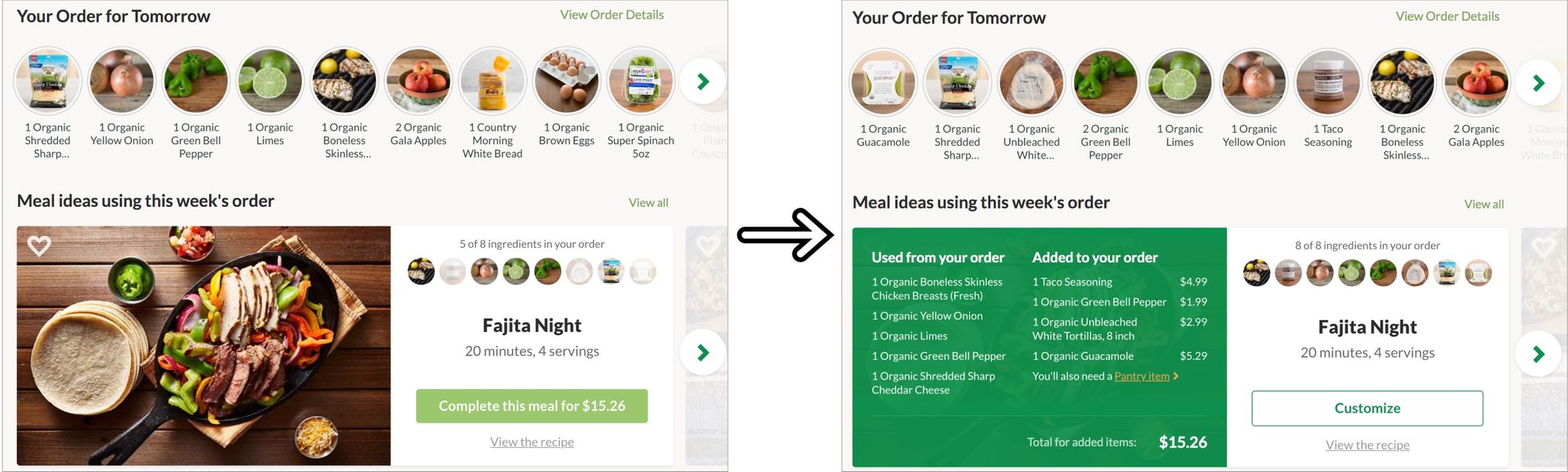

- Furthermore, we also recommended recipes that would "use up" products that you had already added to your cart (e.g. you have 3 of 5 ingredients in your cart already for this recipe). We could even tell you how much extra $ the remaining ingredients would cost if you were to add them to your cart (e.g. "the remaining items needed for this recipe will only cost you $5 in addition to the current $ total of items in your cart").

- We used NLP (natural language processing) to parse recipe descriptions in order to separate each ingredient into quantity, unit, and product type (e.g. “1 cup spinach, freshly chopped” => "1" + "cups" + "spinach"). This allowed us to do all sorts of interesting serving & ingredient math on the customer's behalf.

- For each ingredient in a given recipe, we ranked the best products from our catalog for that ingredient by 1) what was already in your cart (e.g. I already have spinach in my cart, so get more of that kind), 2) your dietary preferences (e.g. I'm allergic to gluten so choose the gluten-free bread instead), 3) your shopping history (e.g. I always buy X brand so choose them if possible), and 4) sales & features (e.g. The chicken from farm Y is on sale this week, so use that one). In this way, every recipe (and resulting items added to the cart), was personalized per-user and per-order automatically.

- When auto-adding the best product for a given ingredient to your cart, we knew the quantity of the item to add based on your selected serving size (e.g. 6 servings), the amount the recipe called for (e.g. 4oz), the unit size of the product (i.e. this tomato sauce contains 8oz, vs others that contain 15oz), and if the item was already in your cart, what % of it was already "spoken for" by another recipe (i.e. this recipe calls for 4oz and that recipe you already added calls for 8oz, so you just need 1 can of 15oz to cover both recipes).

- You could explore recipes by a number of factors (e.g. diet, cuisine, theme, primary ingredient), and there was even an interactive tool that allowed you to choose certain products in your cart and only see recipes in the catalog that could specifically make use of those products.

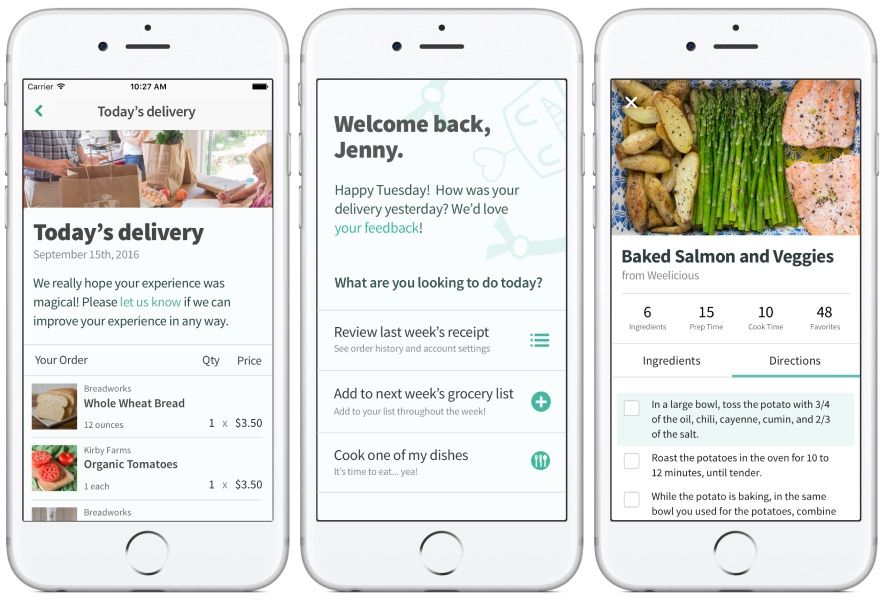

- Anywhere you saw a recipe on the site, you could, with 1 click, add that recipe and all the required products (according to the logic above) to your cart. You could then customize it, e.g. swapping one product for another for a given ingredient, changing the quantity of something, removing items, etc. We even knew to not auto-add ingredients that were commonly found in pantries, though this was configurable.

- Our team's favorite: while viewing a recipe page on most popular recipe websites (e.g. All Recipes), a customer could, with 2-clicks (and no data entry), use a Chrome Extension to automatically import that recipe into Relay, which parsed its image / description / ingredients / etc. and auto-added all the necessary products to your cart with all of the smarts listed above.

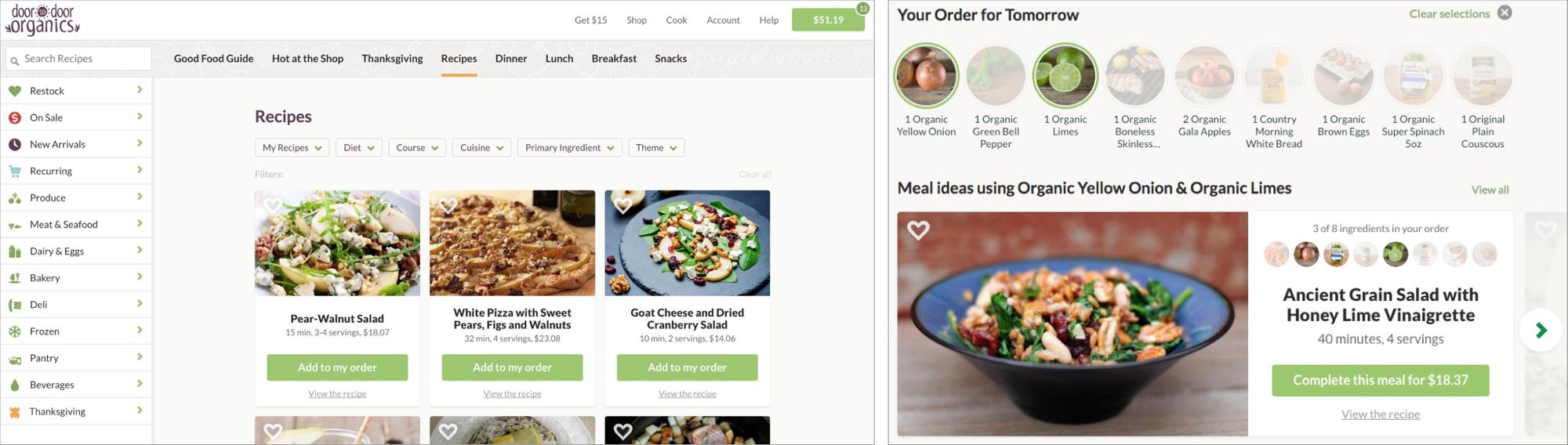

Here are some screenshots of the above in action (at different stages of company/product evolution):

So What Happened?

Startups are hard. Particularly startups that burn millions of $ of cash each month operating warehouses, delivering groceries, and marketing against established players in an industry that investors were not yet ready to invest heavily in (but were quite excited about).

Shortly after the Meal planning launch, we got mired down in fundraising and M&A (Merger & Acquisition) discussions, ultimately joining forces with Door To Door Organics. We worked hard to combine the best of the two companies, including rebuilding the Door to Door website with Relay technology, but it was too little, too late. Although we were beginning to receive some great feedback and see similar metrics as above, the company was running out of money. Then Amazon bought Whole Foods – a market event which froze interested investors at the worst time for us. We closed the business abruptly in November of 2017, and the parts were auctioned off.

I'm publishing this article now because I believe the business would have been much more successful had it originated these days: investment in grocery is high, and consumer behavior around food delivery is changing rapidly.

Outside of market effects, I certainly wish there were things that I had done differently along the way that might have changed the outcome. In fact, I owe the success of my product strategy consulting business in large part to the hard earned lessons from my time in online grocery!

Are there similar things out there now?

Probably :) I don't follow the space nearly as closely anymore. That said, I have enough experience to have seen some common trends play out:

- Most big grocery companies (Amazon, Walmart, Kroger, etc.) that "go online" more or less replicate the in-person buying process, which is lacking for the reasons described above.

- "Meal kit" companies (HelloFresh, BlueApron, etc.) seem easier and thus get a lot of trials, but have a very hard time retaining customers because most people realize they don't want to "learn" several new recipes every week.

- B2C meal-planning-focused companies (Whisk, Innit, Mealime, eMeals, CopyMeThat, etc.) have solid technology, but because they aren't deeply embedded into a grocery store's catalog, aren't as likely to gain customer traction & can't offer as seamless an experience (though this may change).

- B2B / SaaS meal-planning-focused companies (Locai Solutions) offer many of the features described above and in a way that enables the grocery companies to embed meal planning technology into their own website, but are beholden to the adoption & integration speed of those grocery companies. (Note: I'm an adviser to Locai Solutions).

Anything Else?

- I would be remiss if I didn't thank the awesome people I worked with at Relay Foods & Door to Door Organics. This article focuses on product/UX/technology, but there were tons of talented folks in marketing, merchandising, operations, and more that contributed a ton to this endeavor.

- I am particularly thankful for my amazing Product/Engineering/UX/Data team members that continually out-did themselves over the years. This tweet is about them:

Was asked by a former colleague what made our product/engineering team so great. My response:

— Jeff Bordogna (@jeffthink) July 15, 2020

1) Collaborative / low-ego people working in 2) a creative / low-friction environment on 3) a product that we clearly loved / wanted to see exist in the world.

3. I was always fond of this wireframe I put together as the very first ideation that would become Meal Planning. Maybe it will inspire someone out there:

If you're interested in hearing more about my experiences in online grocery, let me know. In the meantime, here are two other posts I've written so far:

And as is my tradition, enjoy this song to cap off your reading experience: